Adapting to Environmental Changes: The Case of mReader Implementation in the Banking Industry

Introduction

The United Nations Conference on Sustainable Development in Rio de Janeiro in 2012 gave birth to the Sustainable Development Goals (SDGs). The aim was to create a collection of common goals that addressed the world's urgent environmental, political, and economic challenges. The focus of this study is on how the banking sector can sustain and survive in difficult times. As a result, to thrive in business, the banking industry must continually adapt its operations to the constantly changing environment. Several changes have occurred in the global economy, especially in the banking sector, particularly in the context of the covid pandemic Bank need plans that are based on their operations and cope with emerging environmental and market issues effectively to succeed in this competitive climate.

The aim of this study is to determine the UN Bank's responses in the face of increasing environmental changes. Therefore, the case is about introducing the new technology in the existing system of the bank which is mReader. This will be the effective way of the users to withdraw money from the bank without using a card especially in covid pandemic situation. So, the customers can withdraw the money without touching any surface which helps to prevent the spread of the virus because they just need to hold the card near the card reader which will be available in the ATM Machines. This idea comes into mind due to the spread of the virus and also mReader will be compatible to all smart phones to reach the target audience. As we know, all the customers are not able to buy expensive phones for instance, Apple. Hence, this app will be available in cheap phones as well. Also, to reduce the environmental issues it the best way to use the money without having any plastic card with the chip in the pocket. Moreover, the importance of the service becomes very evident as bank customers face problems like card cloning, card damaging, card expiring, card maintenance and so on. This document explains the brief, description, stakeholders involved, data collection strategies and appropriate functionality of the reader system. The proposed solution system will make use of banking application in the mobile phones for authentication purposes and to take control of the self-access to the ATM.

Problem of the project

It has already been discussed that the competition level for the banking companies have increased to a great extent. So there has been a big problem in front of the organisations like UN Bank in which they have to understand the changing dynamics of the market conditions and have to offer the products according to the needs of the market (Deloitte, 2021). The future competitiveness of the bank is dependent on how they are able to adapt the product and move according to the expectations of the market effect of the mindset of the people has developed a great extent towards corporate social responsibility is of the banking sector and it is one of the problem area which will be focused in the project. The entire discussion will be made on what kind of initiative could be taken by the banks to be able to deal with the problem areas.

Objective: The study's aim is to see how the UN Bank responded to shifting public needs and demands. Technological, economic, and social factors are the three types of factors. The UN Bank's second target is to see how it responded to changes in industry strength. The threat of entry, the threat of a replacement product, customer bargaining power, supplier bargaining power, and sustainable racial rivalry. Moreover, this study is to determine which strategies are being used by UN Bank to respond to competition in the banking industry. Hence, the main aim is the product should be compatible to each smart phone so that it could reach to the target audience.

Objective of the project

Important tool which helps in giving a clear understanding about the objectives of the project (Bjerke & Renger, 2017). Some of the objectives in relation to the project are as follows:

The smart Framework is a very important tool which helps in giving a clear understanding about the objectives of the project (Bjerke & Renger, 2017). Some of the objectives in relation to the project are as follows:

Target audience

The different types of target audience for which the solution has been defined. This will majorly include the management people and the employees working at the organisation. A complete list will be presented at the time of the presentation of the solution. The changes have to be executed by the employees and the managers working at the different branches of the bank and it will involve a proper commitment of the top management of the bank. The suggestion will also be provided keeping it to mind the changing dynamics of the environmental conditions and the customers for which the bank is being operating and is focused on providing the best services. Not only the bank but this research can also be utilised by the other banking companies which are operating in the banking sector so that they can understand that how the need to make changes in their business model to be able to survive to the changing conditions. The bank is operating in the service sector and the future success of the bank will be dependent on the efficiency with which they are able to provide the services .So the target audiences will be mainly the people that will be working as the change mechanism for implementing the change process at the organisation and at the same time it will be implemented through the operation of the top management. They need to provide time to time training to the bank officials for implementing the new solutions.

Critical success factors

These can be defined as the important result areas and the activities which have to be completed for maintaining the highest standard of quality for achieving the goals of the organisation. The most important is success factor which is applied in this case is the ability of the banking sector to manage the different types of interest of the different stakeholders in relation to the entire industry and the organisation (Schubert, 2021). They have to understand the Expectations of the customers and have to manage their requirements. So the feedback from the customer can be one of the indicator which will help understanding that whether the solutions are working properly or not.

Description of the project

The project is focused on understanding the existing problems faced by the banks and then suggest some of the solutions for which would the help them to deal with the issue at constant changes are taking place had they have to make the best use of the technology and at the same time have to be sustainable in the kind of the products of which they provide to the people. There are different approaches the for the researcher and in this case the explanatory study will be chosen because it will help in finding answer to the question and the problem faced by the bank (Park Jeong-Soon, 2014). They will help in investigating the cause-and-effect relationship and will help in probably finding out the best solution for the bank (QuestionPro, 2021). This method has been chosen because it will help in investigating the problem that is not clearly defined under to get better understanding of the existing problem. The basic concept will start with the general idea and how it will help in a researcher to identify the issue and the focus will be made on the future research. There are different methods are which can be utilised in this case and most prominently the focus will be on making use of the secondary research methods. The attempt will be together information from the previously published primary research. So the focus will be to get information from the different sources like magazines, newspaper articles, journals. The effort will be put that the research will be collected from the authentic and the genuine website articles to get the required information. At the same time, the literature review will also be conducted of which is one of the inexpensive method of for discovering hypothesis and at the same time it will help in getting more information about the research which has been made previously. The attempt will also be made in the research to do the case study research. In this the evaluation of a different types of contributions that have been made by the other banks for the kind of Technologies which have been used by them so that they are able to become more sustainable. So collaboratively the research will collect the information from the different sources and will provide a directional for recommending a particular solution which could be used by the bank.

A Stakeholder Mapping:

The representation of employees plays an important role to protect the interest of employees. The representative will address all of the employees' issues and concerns to UN’s bank management, as well as counsel board members of this bank about how to invest in employee benefit programs. Due to this, the bank can sustain for long term. The IT field employees can also address the card less withdrawal project through their programming skills and solve all customer (regardless of their age, culture, religion) issues in term of technology. The government will impose their rules and regulation on the IT project of United nation bank so banks have a need to meet the government policies. For example, most of the china’s country app’s cannot be access worldwide because it is the rule of china government that the app benefits can be enjoy by china people. This project will include every category (children adult, senior citizens) of clients of UN’s bank. All the clients who has the smart phones can get the benefit of card less withdrawal project. This will maintain equality among the clients of UN’s bank. For example, apple valet (in which clients scan their card) feature from the banks is only available for the clients who has apple phones which creates the inequality. Due to this the customer changing need will be met by bank.

Data Collection Strategies

The United Nation (UN) can use the below data collection strategies for achieving their goals like to reduce cope with the climate change and planet on the future of money.

Data collection strategies:

Primary Data: Original data that has been obtained specifically for the reason in mind is referred to as primary data. It means that the information was gathered directly from the initial source.

Secondary Data: It refers to data that has already been compiled and analyzed by someone other than the client.

Quantitative Data: There are data that deal with quantities, values, or numbers in order to make them quantifiable. As a result, they are often represented numerically, as in length, size, quantity, price, and even duration.

Qualitative Data: These data, on the other hand, are descriptive rather than numerical in nature and deal with quality. They are usually not observable, unlike quantitative data, and are mostly gathered by observation

PRIMARY DATA COLLECTION STRATEGIES:

Experiments, surveys, and observation or direct contact with stakeholders are all ways to gather primary data by the banks to make the money good for everyone in future while conducting experimental or descriptive studies. The following are a few methods for gathering primary data:

Observational Method: observation becomes a scientific instrument and a method of data collection for meeting the reqirments of the stakeholders like to meet the changing needs of the clients and rapid growth in technology. There are two types of it as follow:

(a )Structured (descriptive) and unstructured (exploratory) observation- A structured observation is one that is defined by the careful description of the units to be observed, the observer's style, the conditions of the observation, and the collection of relevant data for the observation. Due to this observation, the senior administrator or managers of banks can make the adjustment for improving the effectiveness as well as the efficiency of the bank services delivery. When the characteristics aren't planned advance or aren't present. It's a called unstructured observation.

(b) Participant, Non-participant and disguised observation- Participant observation occurs when the observer acts as if he is a member of the community he is observing. This observation will be more benefical for bank administrator or managers to understand closely that how client actually experience their services Non-participant observation happens when the observer observes without being a member of the group being observed. It is disguised observation if the observer observes in such a way that the people he is observing are unaware of his presence.

INTERVIEW METHOD: This method of data collection includes the presentation of oral verbal stimuli as well as a detailed analysis of oral-verbal responses.It can be accomplished in one of two ways:

(a) Personal interview: It necessitates the use of an interviewer( staff of bank) who will ask questions to the other person in a face-to-face environment. It can be Direct personal investigation, Indirect oral examination, Structured interviews, Unstructured interviews. The unstructured intervies will help bank department to make the equality because in this interviews, there will be no setup structure about who will join the interview. This interview will give the freedom to everyone to present their views about the services of bank.

(b) Telephonic interviews: It needs the interviewer (staff of bank)to gather information by calling respondents (stakeholders ) and asking questions or soliciting their views orally

Secondary data collection strategies:

Secondary data can be found in a variety of places by a bank to meet the stakeholder requirments. There are two types of secondary data: published and unpublished

Published Data is accessible in the following places:

Governmental publications

Technical and trade magazines.

Public documents

Documents that are either statistical or historical

Letters, diaries, unpublished biographies, and work may all contain unpublished data. The following characteristics must be evaluated before using secondary data for future of money by the banks:

Reliability of data: Who was in charge of gathering the information? What is the source of this information? Which tool should use? Is it the right time?Is there a risk of bias? What is the concept of precision?

Suitability of data: The depth and essence of the initial inquiry must be studied, and then the findings must be carefully scrutinized.

Adequency: If the degree of precision achieved in data is found to be insufficient, or if the data are linked to a region that is either narrower or broader than the scope of the current investigation, the data are deemed inadequate.

Qualitative data collection strategies:

Face to face personal Interviews: Because of its personal approach, this is considered the most popular data collection instrument for qualitative study. On a one-on-one and face-to-face interaction, the interviewer (the staff of bank) will gather data directly from the subject the interviewee (the clients of the bank).

Paper surveys or questionnaires: Questionnaires often have a format of short questions, and qualitative questionnaires are also open-ended, with respondents (clients of the banks) being asked to provide specific responses in their own terms. As a result, banks will get idea about how many people are living on poverty line and they can reduce poverty by delivering cost effective financial services to the poor people. For example, low interest rate spreads, avoid costly account fees

Quantitative data collection strategy:

Document Review

The banks can collect data after reviewing the current records of people because It is a cost-effective and reliable method of data collection because records are manageable and provide a realistic resource for collecting eligible data from the past. Due to this data, financial department of UN bank can estimate the poverty headcount ratio and then provide bank services to their clients on equality bases with low cost. For example, banks can provide the facility to their clients by taking the minimum fees on the international money transfer. This will be the effective step from financial department to make the equality in their customers.

Appropriate documented functionality

As the solution prototype is to provide a service to bank customers that can allow them to withdraw money without the use of a card instead, they should be able to use their mobile banking to do the same.

The goals or objectives of a project are defined with the help of certain requirements and the understanding of these requirements aids to determine the work area. Moreover, business and functional requirements support the project managers to forecast the progress and success ratio of the project. However, Business requirements come ahead of functional requirements.

Business Requirements

These requirements should be clear, enough and should provide proper guidance to fulfill all the identified goals and objectives. To make the project realistic there would be high need to train bank staff about the offerings of the new service. To support spread of information, a detailed manual with some graphics can be made. Complete documentation of the project with the final report would be handed over to the UN bank for the successful completion of the project.

We can provide some assumptions to help to achieve the desired goals.

Assumptions:

We assume that all customers know using ATMs.

Banking service is targeting individual customers.

The project management team is assumed to have enough knowledge to make the project successful.

One manager, one designer, four developers, and two testers are a part of the targeted project who work together for the successful completion of the project.

The completion period of the project should be 6 months.

We assume that the new service to be offered is to be implemented through a mobile banking application and a tap reader is available at the ATMs.

Internet facility is always available at the time of testing.

Functional Requirements

As in the Functional requirements, we need to break down all the steps that are needed to accomplish all the business requirements. These requirements should be descripted and should be directed according to the needs or goals of business. Functionality requirements are comprehensive set of steps involved in the projects which can be illustrated as:

System analysis: This step represents the necessity of studying and analysing each part of the system in detail along with addressing existing problems.

Brainstorming: It includes the responsibilities of different team members involved in the project and all the prerequisites, benefits and the differences that the new service will offer to the UN bank.

Literature review: It composes of the research about the operating system of ATM of the UN bank and all the communication technology used in the bank.

Solution prototype: Along with a new service of doing card-less withdrawals, the UN bank will get a solution to increase the work efficiency of ATMs.

Case uses: This means that all the negative and positive outcomes of different situations need to be discussed with all the risk factors involved.

Application flow: In this step development stages of the application are discussed.

Usability test: Along with card-less withdrawal this solution prototype could be used for other situations as well and a usability test will be taken for this.

Integration test: This test will bring the testing of the entire system which will include a new feature.

SRS Documentation: This includes the documentation of the goals or objectives, functional and non-functional requirements, assumptions, constraints applied, and the interfaces required for the project.

Feasibility test: This study should be performed to assess the relevancy of the proposed plan.

Screen and web development: This will help to design the webpage for our service to be installed in the mobile banking of UN bank.

Testing: This step consists of a review and analysis of the proper functioning of the application.

User stories

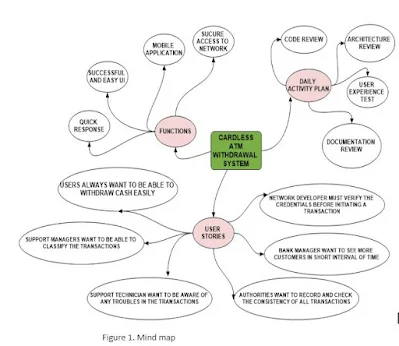

User stories are brief descriptions of what is exactly needed out of the project. Basically, user stories are part of the Agile approach and this is highly preferred because these are simple and consistent and prioritizes requirements. Moreover, it helps to deliver the service which is highly demanded by the customers. User stories ensure the successful completion of projects. We have provided user stories as a part of the mind map which describes the viewpoint of different persons involved in the project.

A clear problem statement to guide the solution process is Bank can use Business process Reengineering strategy which aimed to helps the organisations that they can rethink how they do their work to lauch a final improve customer service, cut operational costs, and become world class competitors.

solution prototype: The final product of the bank will be cradles withdrawl of money like people can click on the cradles option at the ATM and can withdraw money by entering pin only or they can use their phone wallet for the same.

:

References

Bjerke, M., & Renger, R. (2017). Being smart about writing SMART objectives. Evaluation And Program Planning, 61, 125-127. https://doi.org/10.1016/j.evalprogplan.2016.12.009

Deloitte. (2021). Deloitte. Bis.org. Retrieved 17 March 2021, from https://www.bis.org/publ/bppdf/bispap04a.pdf.

Park Jeong-Soon. (2014). Exploratory Research on the Sources of Hedonic Qualities in Digital Games. Journal Of Korea Design Knowledge, null(30), 91-102. https://doi.org/10.17246/jkdk.2014..30.009

QuestionPro. (2021). Exploratory research: Definition, Types and Methodologies | QuestionPro. QuestionPro. Retrieved 17 March 2021, from https://www.questionpro.com/blog/exploratory-research/.

Schubert, J. (2021). Top challenges the banking industry is facing. The Future of Customer Engagement and Experience. Retrieved 17 March 2021, from https://www.the-future-of-commerce.com/2017/07/21/challenges-facing-banking-industry/.

No comments:

New comments are not allowed.